tax per mile uk

The total business miles travelled by an employee is 11500. Cars and vans after 10000 miles.

New Car Tax Changes Pay Per Mile Scheme Could Subject Drivers To Unfair Double Taxation Express Co Uk

UK Might Tax Driving By The Mile.

. This new form of taxation. Once you use these flat rates for a vehicle you must continue to do so as long as you continue to use that vehicle for your business. To use our calculator just input the type of vehicle and the business miles youve.

The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875. Those who travel 12500 miles would spend 1750 on taxes and fuel with those travelling 15000 miles set to pay 2000. Taxing drivers per mile is seen as the most feasible method by the Government so far however a final decision is yet to be made.

UK Might Tax Driving By The Mile. The amount of tax per mile they drive is far less. Similarly if a business chooses to provide an allowance that.

Instead of keeping records of all receipts and then separating. If youre in a full-time job and your employer. Almost two million people supported a petition campaigning against the proposals which would have seen motorists charged up to 130 per mile.

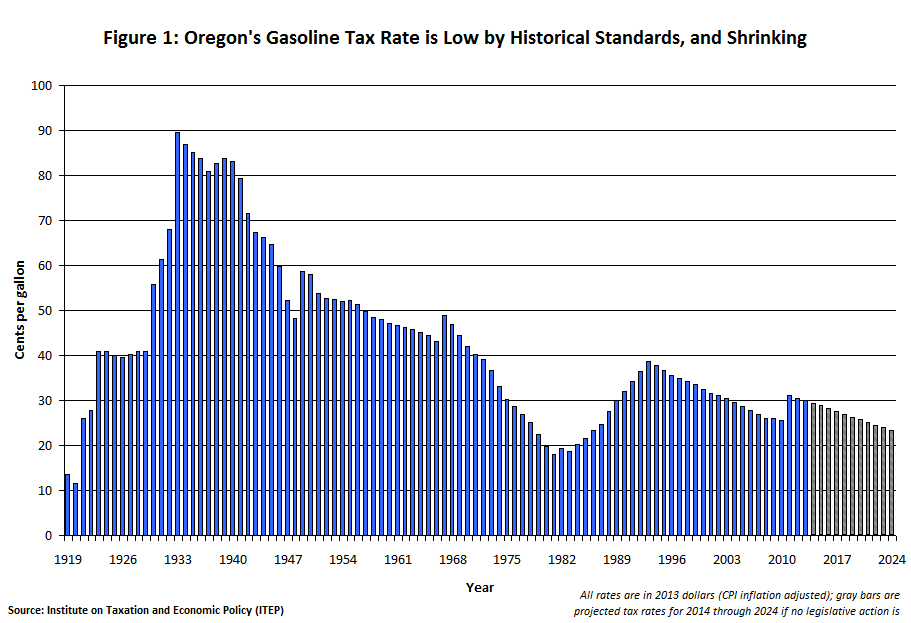

In its latest report. Prompted by fears of rising traffic congestion and greenhouse gas emissions the UK has proposed a new per-mile driving tax that would track drivers movements via sattelite. 45 pence per mile for cars and goods vehicles on the first 10000 miles travelled 25 pence over 10000 miles 24.

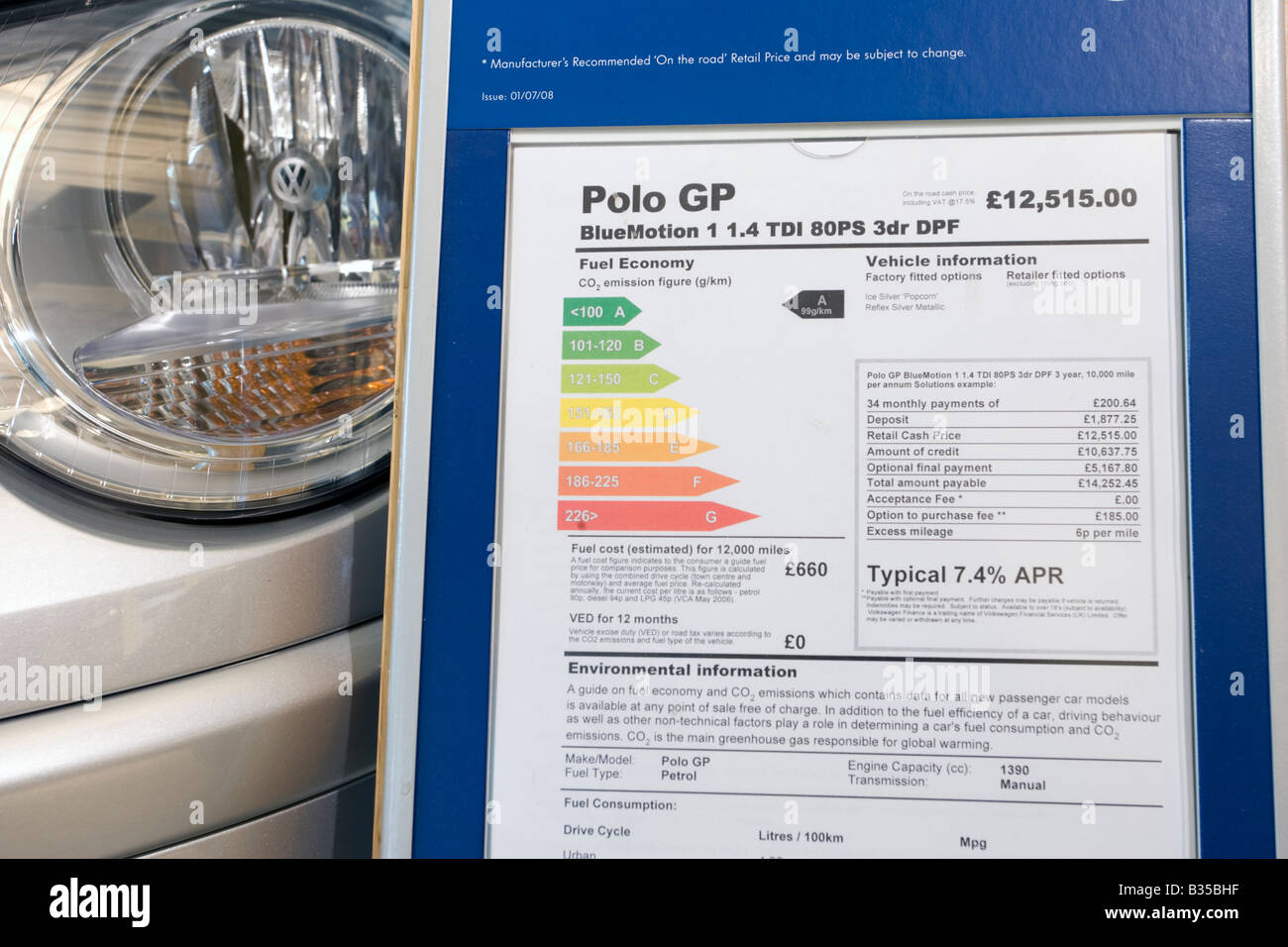

VED is a tax levied on every vehicle on UK roads. The major cost of driving ICE cars is the tax on the fuel. By taxing everyone the same amount per mile would annihilate that.

By taxing everyone the same amount per mile would annihilate that advantage. Once a similar level of tax is applied to electric cars it will no longer be 2 or whatever per 300 miles of range. The current mileage allowance rates 20212022 tax year.

However based on predictions from Nick Freeman. The car leasing experts at LeaseElectricCarcouk have decoded what is meant by tax per mile and how it may impact electric vehicle owners in the UK. Getty The calculations are based on Mr Leathes prediction the costs could be in the.

THE UK must urgently introduce pay-per-mile road pricing to make up the 35bn budget shortfall created by the switch to electric cars MPs have said. The idea behind pay per mile road tax is to replace the current Vehicle Excise Duty and fuel duty schemes which bring in roughly 35 billion for the UK economy. 3 Practical advice for drivers from the Government around lowering carbon emissions.

The amount of tax per mile they drive is far less. A pay-per-mile car tax system would help tackle traffic congestion. Approved mileage rates from tax year 2011 to 2012 to present date.

A rate of 24p per mile applies to motorcycles and a rate of 20p per mile applies to bicycles. In 2008 a survey from the Institution of Civil Engineers showed that 60 of British motorists would prefer. A spokesperson for LeaseElectricCarcouk.

However motoring experts have predicted this could be a flat 75p per mile charge or a varying levy of between 2p and. Fuel duty was cut by 5p per litre of petrol and diesel in March amid record pump prices bringing it down to 5295p. A 75p mile charge over 20 miles a day could cost drivers up to 4000 per year Image.

The employer reimburses at. For traffic and travel info near. Tax per mile uk.

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work. 2 Car tax to be ring-fenced and actually spent on improving our roads - not just for drivers. For example if you receive 30p per mile you can claim tax relief on the difference of 15p per mile for cars and vans.

They need replacing because. New electric car tax is urgently needed warns expert.

Car Tax Changes Telematics Tools Ahead Of A Pay Per Mile Charge Will Analyse Locations Express Co Uk

How Will The Pay Per Mile Scheme Work Leasing Options

Car Allowance Vs Mileage Allowance For Uk Employees

Car Tax Changes New Pay Per Mile Road Pricing Will Be Essential To Fill 40billion Hole Express Co Uk

Car Tax Changes Some Drivers Will Be Exempt From New Pay Per Mile Road Pricing Charges Express Co Uk

Car Tax Mps Call For Pay Per Mile Road Pricing To Replace Revenue From Ved And Fuel Duty Express Co Uk

Furious Voters Slam Peter Buttigieg After He Said White House May Tax Drivers By Per Mile Daily Mail Online

Introduce Pay Per Mile Road Tax To Cut Emissions And Build A Greener Future

What If I Use My Own Car For Business Purposes Low Incomes Tax Reform Group

Uk Might Tax Driving By The Mile

Proposed Bill Could Tax Bay Area Drivers A Dime Per Mile Driven Wired

The Ncc New Motorhomes With A Euro 6d 2 Engine Are No Longer Subject To A Commercial Vehicle Tax Band In The Uk They Are Now Taxed As A Car The

As Electric Cars Become Mainstream Could Drivers Soon Be Taxed Per Mile To Use The Roads The Independent

Uk Government Per Mile Tax Would Solve Global Warming The Truth About Cars

Fuel Economy Rating Chart Blue Motion Vw Polo 1 4 Tdi Pays Zero Road Tax Uk Stock Photo Alamy

Travel Mileage And Fuel Rates And Allowances Gov Uk

Introduce Pay Per Mile Road Tax To Cut Emissions And Build A Greener Future